Table of Contents

Arm chip design – In the dynamic landscape of technology, one company has consistently stood out for its unparalleled contributions to the semiconductor industry – Arm. As we delve into the latest financial revelations, it’s evident that Arm’s ascent is nothing short of remarkable. In this comprehensive analysis, we dissect the factors propelling Arm’s meteoric rise, emphasizing its recent earnings report and forecast.

Arm’s Spectacular Earnings Performance

Surpassing Expectations

The recent surge in Arm’s shares, a staggering 60%, is a testament to the company’s exceptional financial performance. The earnings per share, a critical indicator of financial health, exceeded analysts’ projections. Clocking in at 29 cents adjusted, compared to the anticipated 25 cents, Arm demonstrated not just stability but a robust growth trajectory.

Revenue Triumph

Arm’s dominance extends beyond earnings per share, with a noteworthy surge in revenue for the last quarter. Recording $824 million, surpassing the expected $761 million, the company showcases not only resilience in a competitive market but a strategic prowess that continues to pay off.

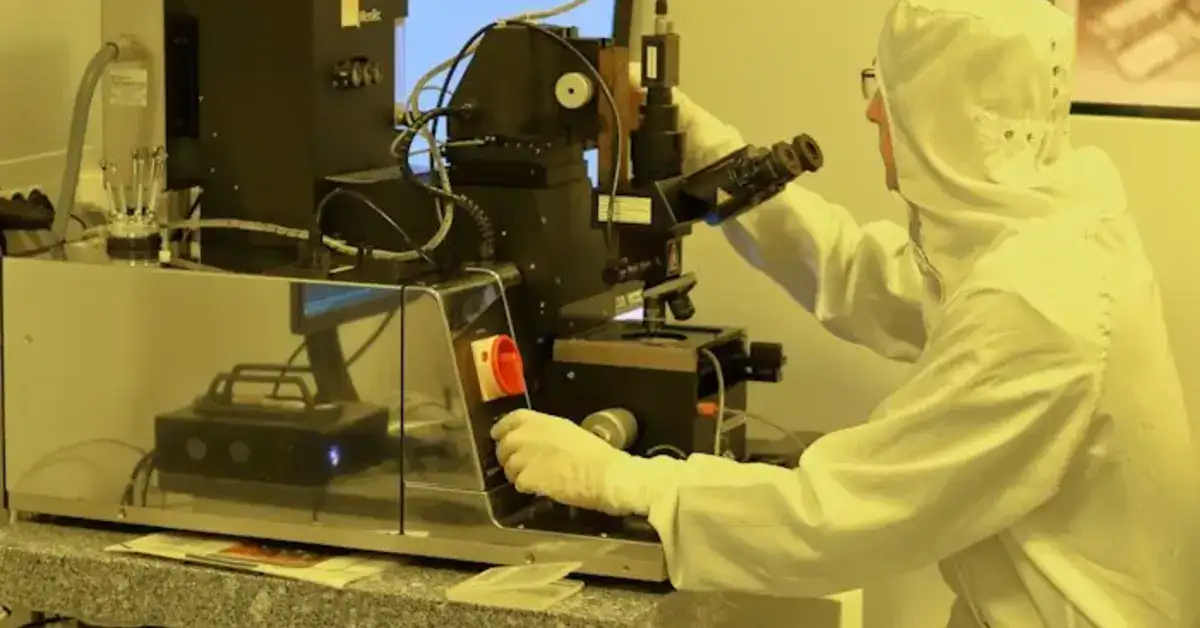

The Backbone of Success: Chip Design Technology

Infiltrating Smartphones and PCs

At the core of Arm’s triumph lies its cutting-edge chip design technology, omnipresent in most smartphones and a multitude of PCs worldwide. This pervasive integration underscores the indispensability of Arm’s innovations in the tech ecosystem.

Forward-Looking Projections

A Strong Profit Forecast

What sets Arm apart is not just its historical achievements but its forward-thinking approach. The company’s profit forecast for the current quarter is nothing short of stellar. Anticipating earnings per share to range between 28 cents and 32 cents on sales of $850 million to $900 million, Arm confidently outpaces analyst expectations.

A Glimpse into Arm’s Journey

From Founding to IPO

Founded in 1990 and acquired by Softbank in 2016 for a monumental $32 billion, Arm’s journey culminated in a triumphant initial public offering (IPO) in September. The IPO, priced at $51 per share, saw a substantial increase, with shares trading just below $100 on a Thursday morning.

Softbank’s Strategic Ownership

While Arm has emerged as a public entity, Softbank’s strategic ownership remains pivotal. Holding approximately 930 million shares, equivalent to roughly 90% of its outstanding stock, Softbank’s continued support underscores confidence in Arm’s trajectory.

Conclusion

In conclusion, Arm’s recent financial triumphs exemplify not only a snapshot of success but a testament to its strategic vision and technological prowess. As we continue to witness Arm’s journey, it becomes evident that the company’s impact extends far beyond financial indicators, shaping the very fabric of the semiconductor industry.

Previous Post